Forex

Commodities

CFD

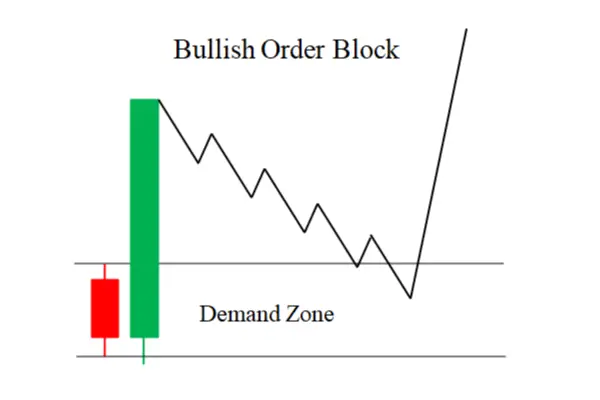

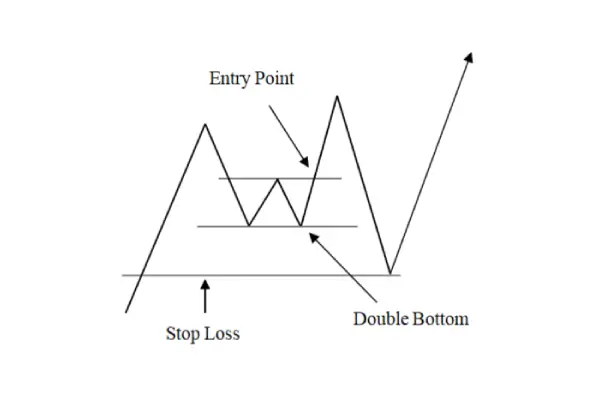

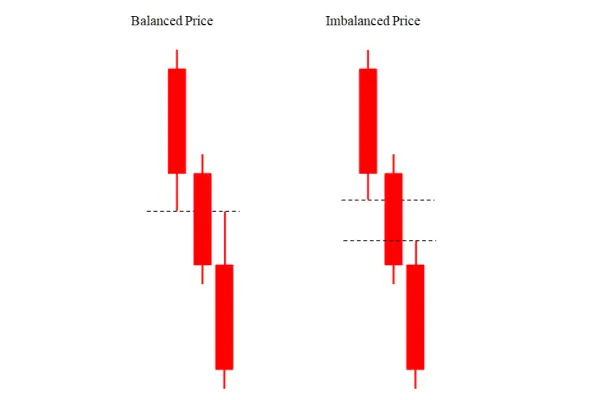

Education

Trading Guide's

Trading Tools