Effective techniques of money management

Money management helps minimize your trading losses, maximize your profits and increase your trading account capital. Many newcomers to the market tend to neglect money management in forex trading, as a result of which new traders are exposed to losses as soon as they enter the market. Many lose their trading account balance in a very short time due to trading without understanding. Therefore, there is no alternative to money management to survive in the forex market. So let's know those money management techniques.

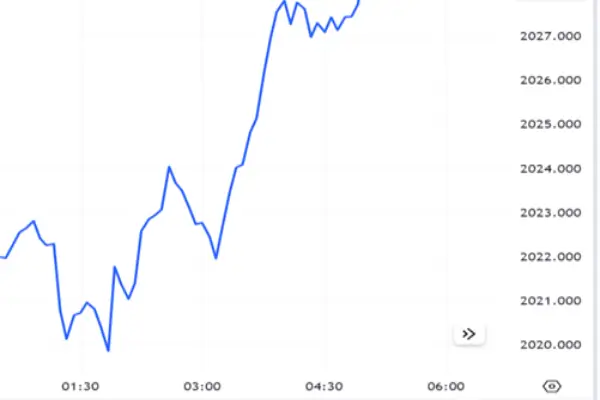

Know the risk of each trade:

Know the risk of each trade before trading. The maximum number of dollars you can lose per trade is called the risk per trade. Many traders recommend taking 2 to 3 percent risk per trade. This will save your trading account from going to zero.

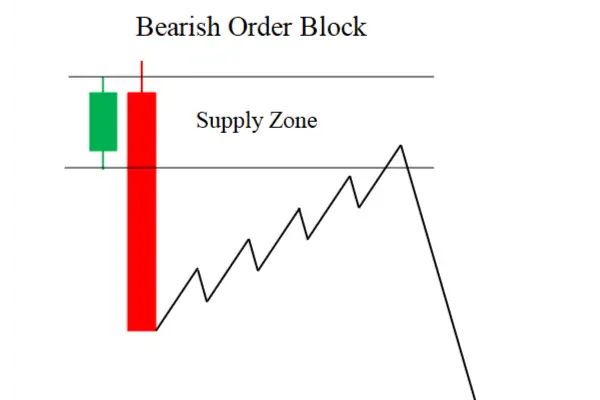

Always use stop loss:

Most traders feel very negative when they hear stop loss. Actually, stop loss is a way by which you can keep your trading account safe from any unwanted loss of your trading. Stop loss should be used at right place as per analysis rather than stop loss based on guesswork.

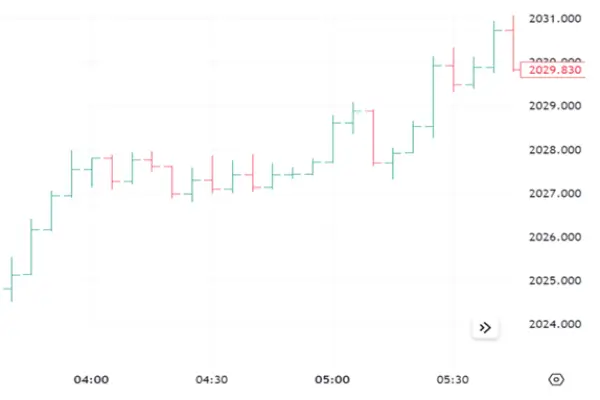

Risk Reward Ration:

Always trade according to risk reward ratio. The risk reward ratio should be at least 1:2 or 1:3. If you take risk $200 per trade you need to profit $400 or $600.

Proper use of leverage:

There is no substitute for leverage to earn more with less investment. Although many brokers offer higher leverage, but too much leverage can be detrimental to your account. Not using proper leverage can affect money management plans.

Proper use of leverage:

There is no substitute for leverage to earn more with less investment. Although many brokers offer higher leverage, but too much leverage can be detrimental to your account. Not using proper leverage can affect money management plans.

Trades should not be taken based on emotions:

The biggest problem for new traders is emotion. New traders constantly lose by trading only on emotions. Repeated stop loss moves are not holding profit trades but holding loss trades for months. Not wanting to accept loss. Breaking money management rules suddenly, over trading etc. and many other things are done under the influence of emotions. If you have confidence in your analysis, let the market prove that your analysis was correct.